EUR/GBP

- Ersteller Rakete

- Erstellt am

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

N

nixx

Guest

:top: ich dümpel da woanderst rum seit heut morgen... :dumm: btw: denke so ~0.87 wäre das eher lfr. Ziel (Flag Oberkante im Weekly)

Mal schauen wie sich der Trade entwickelt. Vielleicht werde ich auf ep wieder ausgestoppt, dann wars eine Nullnummer. Bei 0.8485 wäre der Trade kurzfristig im Ziel. Da würde ich voraussichtlich 1/2 realisieren. Der Rest könnte dann auch ein mittelfristiger Trade werden mit Stop nachziehen, etc. Da könnte ich mir Kurse um 0.87 auch vorstellen.denke so ~0.87 wäre das eher lfr. Ziel (Flag Oberkante im Weekly)

EURUSD?ich dümpel da woanderst rum seit heut morgen.

N

nixx

Guest

EUR/GBP Weekly:EUR/GBP Weekly:

Der EUR/GBP nähert sich auf dem Wochenchart ein sehr wichtigen Unterstützung. Die Monats EMA 200, die ebenfalls in dieser Zone lauert wurde seit über 7 Jahren nicht mehr angetestet.

Der Euro konnte die gute Unterstützung auf dem Wochenchart nicht verteidigen. Setup ist mit dem Break nun aktiv.

The Coming Chaos in the U.K. Election

Investors are already paying more to protect themselves against a weaker pound as political uncertainty mounts. Last week, the cost of those options reached the highest in more than three years, while a gauge of the pound’s future volatility has climbed more than that of any of the other major currencies this year.

None of the possible scenarios suggested by current polls points to stability for either the political landscape or the economy, analysts at Bank of America Corp. said in a Feb. 13 research note. Steve Barrow, the head of Group of 10 strategy at Standard Bank Plc in London, recommends hedging sterling investments through the election, and also its aftermath.

“The market is prepared for the bad, or the very bad, but not for the disastrous,” Barrow said by phone.

EUR/GBP Weekly: UpdateEUR/GBP Weekly:EUR/GBP Weekly:

Der EUR/GBP nähert sich auf dem Wochenchart ein sehr wichtigen Unterstützung. Die Monats EMA 200, die ebenfalls in dieser Zone lauert wurde seit über 7 Jahren nicht mehr angetestet.

Der Euro konnte die gute Unterstützung auf dem Wochenchart nicht verteidigen. Setup ist mit dem Break nun aktiv.

EURGBPWeekly.png

Setup hat hervorragend funktioniert. Aktuell etwas weit in der Bewegung. Ob eine grössere Gegegenkorrektur kommt zum aktuellen Zeitpunkt ist fraglich, den der Euro ist weiterhin sehr schwach.

Pound Traders Awaiting BOE Data After Biggest Jump in Six Weeks

Pound traders are waiting on a slew of Bank of England data that may bolster the prospect of higher interest rates and extend the currency’s gains.

Sterling climbed against all 16 of its major counterparts in July as a report showed Britain’s economic growth accelerated in the second quarter. The central bank will simultaneously publish new economic forecasts, its next policy decision, minutes of the corresponding Monetary Policy Committee meeting and officials’ votes on Aug. 6. In July, all nine MPC members voted for no change in the key rate.

Pound's Prospects Seen Torn Between ECB, Fed as Policies Diverge

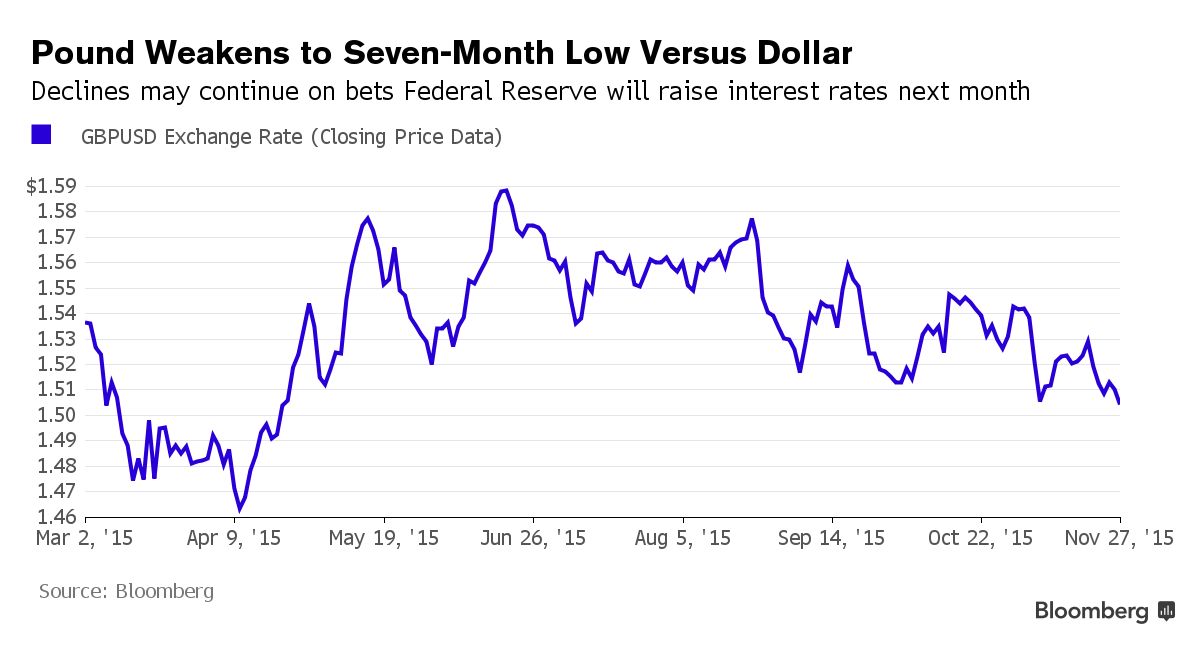

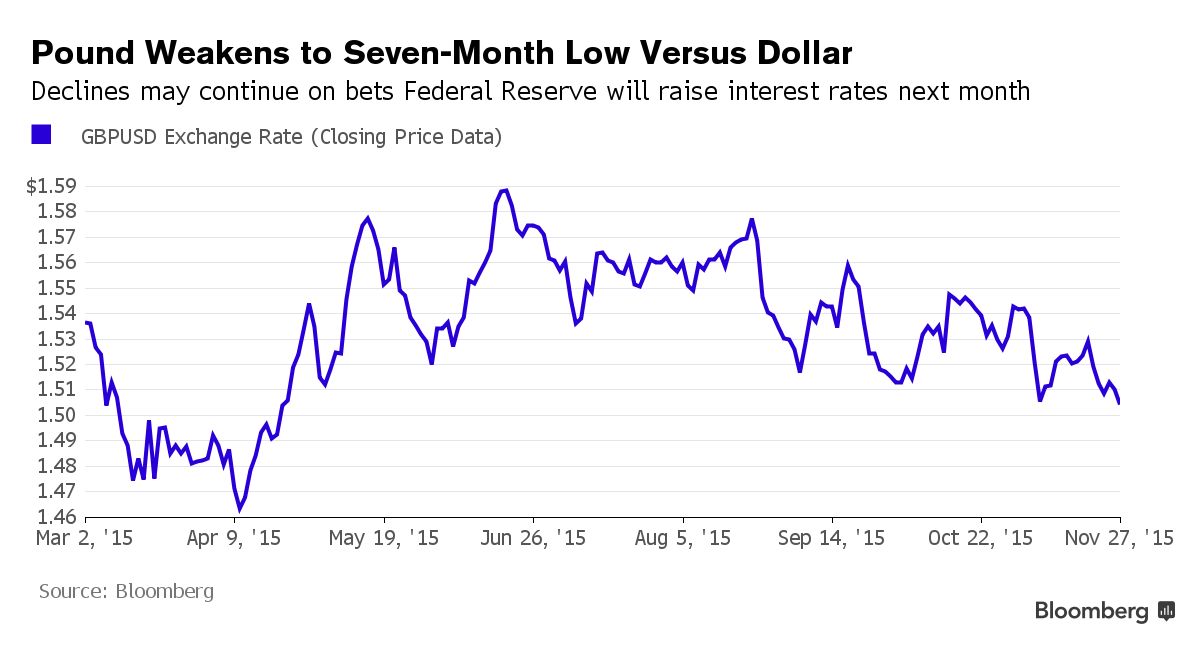

Das GBP hat sich in den letzten Wochen gegenüber dem USD abgeschwächt, nachdem BOE's Governor Carney betonte, dass ein eventueller Zinsanstieg nur graduell erfolgen würde. "Graduell" auch ein beliebtes Wort von Mrs. Yellen -> Was meint die Fed mit «graduell»?

Hier noch die Grafik von "the cable"

Neben dem GBP dürfte sich auch der CHF diese Woche durch Fed- und EZB-Entscheide in die eine oder andere Richtung bewegen.

The pound’s fortunes are likely to diverge next week, pulled higher by the European Central Bank and dragged lower by the Federal Reserve.

Das GBP hat sich in den letzten Wochen gegenüber dem USD abgeschwächt, nachdem BOE's Governor Carney betonte, dass ein eventueller Zinsanstieg nur graduell erfolgen würde. "Graduell" auch ein beliebtes Wort von Mrs. Yellen -> Was meint die Fed mit «graduell»?

Hier noch die Grafik von "the cable"

Neben dem GBP dürfte sich auch der CHF diese Woche durch Fed- und EZB-Entscheide in die eine oder andere Richtung bewegen.

Im folgenden Artikel ist allerdings nicht vom EUR/GBP sondern vom GBP/CHF die Rede.

The Currencies to Watch in 2017

The Currencies to Watch in 2017

The pound, krone and rand are the currencies to watch heading into 2017 as technical charts and supportive cross-asset themes signal their recent momentum may continue.

While GBP/CHF trades below the down-trendline from December 2015, leading MACD has already broken out bullishly, pointing to more spot upside. There’s scope for a deeper retracement to 1.3403-1.3603 (50 percent retracement and 61.8 percent Fibonacci, trendline and cloud base) where tactical consolidation may emerge. Above here will bring into frame a 1.40 target-zone (9 percent from the current spot), which captures a larger order Fibonacci and cloud top (note: cloud top drops to 1.35 in late March). High-price distribution at about 1.40 may trigger another round of consolidation.

A weekly close below 1.2253 would question the bullish setup.

Deutsche Bank empfiehlt short auf GBP

Deutsche Bank's Five Reasons Why the Pound Is Overvalued

Deutsche Bank's Five Reasons Why the Pound Is Overvalued

- Politische Risiken

Suggestions the U.K. may prioritize migration curbs over unfettered access to the single market drove a rout in the sterling and the gilt market in October.

- Kapitalflüsse

Foreign purchases of gilts could soon run out of steam, given consensus projections that inflation-adjusted gross domestic product will fall next year, the strategist observes.

- Faire Bewertung

"Contrary to popular belief, sterling valuations are not at extremes. Indeed, versus the euro, our PPP model suggests the pound is now expensive,"

- Zinsspreads

The difference between U.S. and U.K. bond yields hasn't been this wide since May 2000.

- The dragon in the room (China)

The U.K.'s currency is also vulnerable to a weaker yuan. Amid capital-outflow pressure Chinese foreign-exchange reserves fell by $70 billion last month — the most since January.